The future of gas

Learn about what the future of gas could look like in the UK and how Xoserve are preparing our systems for a net zero future.

What is the future of gas?

The future of natural gas is a topic of intense debate and requires careful strategic planning.

Natural gas is used in 22 million UK homes, while the UK’s industrial sector consumes a fifth of gas demand, plus generates a third of the country’s total electric power.

There’s no question that gas is deeply embedded within the nation’s energy system.

As such, there’s no single, definitive answer to what the future of gas might look like. But as the central data service provider (CDSP) for Britain’s gas industry, Xoserve is committed to making sure that all systems and services are ready for its evolving role.

Several key models, budgets, and authorities are anticipating what the future of gas might look like. These include:

Tasked with planning and operating the UK’s energy system, NESO publishes the FES every year.

These represent different, credible ways to decarbonise the country’s energy system, as it strives towards its net zero ambitions.

The carbon budgets set a legally binding cap on the maximum level of emissions for a period of five years.

These are set by the independent CCC, the UK’s statutory advisory body on climate change, guiding the government on its emissions targets.

DESNZ leads on the government’s mission to make the UK a clean energy superpower.

It’s responsible for the initiatives and policies that aim to secure the UK’s energy security, protect billpayers, support economic growth and reduce emissions.

A wide range of technologies are available to support Britain’s journey towards decarbonisation. Learn more about some of these technologies on our dedicated webpages:

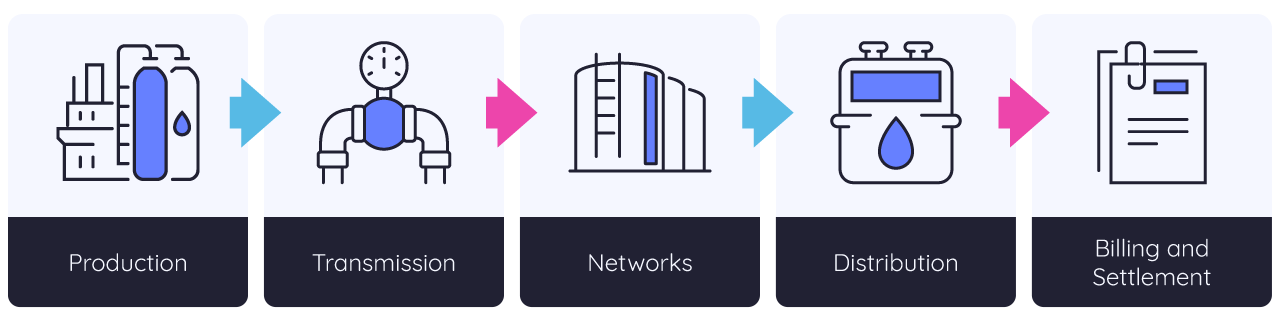

What could a future gas value chain look like?

Because the exact future of gas is still being shaped, the industry has an incredible opportunity to strategically redesign and optimise the gas value chain. By preparing for multiple scenarios rather than waiting for a fixed roadmap, the UK can remain both resilient and adaptable to change.

Regardless of whether the future of gas involves hydrogen, biomethane, CCS or a blended gas mix, the future gas value chain could look very different to how it is now.

The origin of gas could be transformed at a fundamental level. Beyond extracting natural gas, the future will heavily rely on generating low-carbon alternatives. This means factoring in everything from anaerobic digestion (AD) plants that turn organic waste into biomethane, to the various methods for producing hydrogen.

This shift in production will demand new and updated infrastructure, supply chains and regulatory frameworks, ensuring a steady and sustainable supply of gas for the future. It also may include a new certification to validate the origin and emissions of low-carbon gas produced.

National Gas is already developing infrastructure to transport low-carbon hydrogen as a replacement for natural gas. Starting regionally with industrial clusters, a future decarbonised transmission network will likely see these clusters join across the country, repurposing existing natural gas assets where possible.

Projects such as Project Union are exploring how Britain can develop its hydrogen backbone.

In the future, Britain’s gas networks will need to accommodate a mix of different gases. This means the industry might need advanced blending or quality monitoring systems to ensure everything flows smoothly.

We may also need new infrastructure specifically designed for transporting hydrogen. No matter what the future of gas looks like, the gas networks must always be able to efficiently move energy where it's needed to meet demand.

The gas flowing through Great Britain’s local distribution networks (LDNs) could change dramatically. This means our existing pipes and equipment might need to be adapted for new types of gas.

For example, we might need upgrades to pipeline materials or other adjustments to ensure safe and efficient delivery. The goal is always to get the right gas to homes and businesses reliably, no matter its composition.

As the gas we use changes, how we bill and pay for it will become more complex. Different types of gas have different energy compositions, called calorific values. This means we'll need to accurately measure and charge for each type of gas. Getting this right is vital for fair customer billing and to make sure energy is managed efficiently.

To do this, we'll need advanced data systems and incredibly reliable ways to settle payments. Initiatives like the Real Time Settlement Methodology are exploring how this can be achieved in a multi-energy future.

How Xoserve is preparing for the future of gas

For two decades, Xoserve has held an indispensable role within Britain’s gas industry. As we mark our 20th anniversary, we will continue to evolve in our capacity as the CDSP, against growing decarbonisation efforts and market changes.

Ultimately, it is not our role to assume or determine policy decisions. Instead, we are strategically positioning ourselves so that we can rise to meet the demands of any credible gas future.

Xoserve continues to develop its operations and expertise to support customers and the wider industry in navigating potential changes. We proactively engage with key stakeholders, believing that collaboration is fundamental to the gas industry’s long-term success. This includes:

- Thoroughly exploring the technical feasibility of any future options

- Carefully considering the commercial implications of any decisions

- Reviewing the regulatory requirements of any potential pathways

Commenting on Xoserve’s strategy for the future of gas, our CEO, Steve Brittain, said: “Our strategy is simple - we’re getting ready for whatever the future of gas holds. Instead of just watching the energy transition, we’re actively preparing our systems to make it happen.”

Our forward-looking strategy is built on three key principles.

- Trust through greater transparency and finding new ways to add value.

- Innovate to facilitate the net zero transition.

- Deliver robust CDSP services for both present and future needs.

Programmes of work

Xoserve’s strategic approach to the future of gas is reflected in several key areas:

We’re taking a closer look at the issues surrounding energy system transformation in some of our latest blogs. From considering whether a world without gas is achievable, making a case for investing in data to decarbonise energy, and asking whether Britain can afford to ditch natural gas, we’re getting the industry thinking about what transformation involves.

From H100 Fife, a groundbreaking trial that’s supplying 300 homes with 100% hydrogen gas, to National Gas Transmission’s Guarantees of Origin (GoO) scheme for hydrogen, these projects demonstrate the real-world work underway around the future of gas.

Accurate and reliable data is the foundation of any future gas market. Whether it’s the Gemini System or UK Link, we’re always looking at how the future of gas will impact our data systems and how they’ll need to be updated accordingly.

Our most recent programme of work – Managing Different Gases – has analysed the impacts of four different transition scenarios on our CDSP systems.

We also provide data that supports key certification schemes, informs industry working groups that shape the future gas market, and enables innovation through projects like the Real Time Settlement Methodology (RTSM).

We’re committed to raising awareness about gas decarbonisation.

Sign up to attend our monthly decarbonisation meetings, read our monthly DeliveringDecarb newsletter, or explore our dedicated Decarb Discussions podcast.

The gas industry must adapt for Britain's energy transition

Our CEO, Steve Brittan, shared his thoughts on the future of the gas network and how the industry can use low-carbon gas alternatives to reduce emissions in a recent news article.

Common queries

A full transition to a decarbonised energy system is not possible without a clear understanding of the future of gas. Revolutionising an established energy system is a massive undertaking, involving significant costs, resource gaps and infrastructure overhauls.

For this reason, the UK Government founded NESO to bring a unified, whole-system view to energy, treating gas and electricity as interconnected domains. This joined-up approach is critical, as the energy industry needs substantial time to prepare for such profound changes. This will involve adapting business models, investing in new technologies and retraining teams across the entire value chain.

While electricity often dominates decarbonisation conversations, gas provides essential flexibility, reliability, and seasonal storage capacity. The UK’s extensive gas infrastructure is a valuable asset that can be adapted to transport low-carbon gases like hydrogen and biomethane. Leveraging these networks is important for building a diversified, resilient energy system that can meet demand while progressing toward net zero.

The journey to net zero is a complex, long-term undertaking. As such, some critical decisions need to be made. For instance, as demand for natural gas declines, some parts of the network may be repurposed for new fuels like hydrogen or CCS, while others may be decommissioned. This requires a systematic and planned approach to manage the extensive national network.

Elsewhere, key government publications like DESNZ’s Midstream Gas System update and Ofgem's latest RIIO-3 price control proposals provide strategic direction on the future of natural gas and the funding required for a successful transition. These documents signal an ongoing need for clarity on policies like biomethane subsidies and hydrogen levies to support a cohesive market.

As highlighted in NESO's FES 2025 report, the gas network's essential role must evolve to support a range of different low-carbon gas futures. Xoserve is actively preparing for this transition. For instance, our Project Trident initiative is modernising the UK Link platform to ensure it remains agile and ready for the profound changes ahead.

Europe is still dependent on natural gas, particularly imported gas. As of 2021, gas made up 23% of the region’s total energy supply, with 85% of it brought in from elsewhere. As such, moving away from these supplies isn’t just essential for environmental purposes, but for energy security too.

Russia’s invasion of Ukraine has exposed and hastened this transition. Approved in 2020, the European Green Deal had already set out that unabated fossil fuel contracts couldn’t run past 2049. However, the impact of the Russia-Ukraine war on EU energy security led to the development of the RePowerEU plan in 2022.

Alongside the Revised Directive EU/2023/2413 and the EU Hydrogen Strategy, this plan accelerates the switch to clean gas alternatives and reduces EU reliance on Russian energy by:

- Taking a common gas procurement approach for the whole region, ensuring a consistent supply of affordable energy via AggregateEU and the EU Energy Platform

- Stopping all imports of Russian gas by December 2027

- Producing 10 million tonnes and importing 10 million tonnes of renewable hydrogen by 2030, with the aim of it covering 10% of EU energy by 2050

- Delivering a Biomethane Action Plan via the Biomethane Industrial Alliance and produce 35 billion cubic metres (bcm) of the gas by 2030

Establishing the correct infrastructure and a competitive renewables market are the main barriers to an effective energy transition. To overcome these, further directives and strategies have been developed to ensure the affordability and viability of green hydrogen and biomethane production and use.

Directive (EU) 2024/1788 and Regulation (EU) 2024/1789 were adopted in May 2024 to establish common rules for the internal renewables market. They also contain measures which protect consumers’ rights in line with those currently used for the electricity market. This will ensure EU customers get the best energy deals and experiences.

These directives also set out the policies for creating a shared, coordinated infrastructure for alternative gases, including hydrogen. To ensure this focused cross-border approach, the European Commission also approved the creation of the European Network of Network Operators for Hydrogen (ENNOH). Plus, the European Hydrogen Backbone (EHB) is a coordinated plan to repurpose region-wide gas pipelines for hydrogen.

These measures have given individual countries greater confidence in the alternative gas market. This has led to:

- Germany becoming a leader in hydrogen gas development, with €18.6 billion of its Climate and Transformation Fund being dedicated to this up to 2027

- The Netherlands setting a green gas production target of 2 bcm by 2030

- Denmark aiming to fully decarbonise its gas grid by 2035, with 40% of its supply being sourced from domestic biomethane as of 2023

- France developed 731 biomethane production sites which were injecting the gas into the network, with a total capacity of around 13.8 TWh per year. The country aims to quadruple biogas production to 50 TWh by 2030

The UK and EU are navigating the future of green gas through differing policy frameworks. As highlighted in Ofgem’s preliminary Strategic Direction Statement, a key concern is the potential for regulatory divergence between the UK and EU.

Given the interconnected nature of our gas networks, addressing these differences and aligning on key policies will be crucial to fostering a cohesive and efficient renewable gas market in Europe - one that benefits both consumers and the environment.

More information

If you want to know more about any of the above please email us at decarbonisation@xoserve.com.

.